Making Microschool Governance Work for You

When considering creating a microschool, founders generally begin by focusing on education vision and decisions. It is important at this stage to...

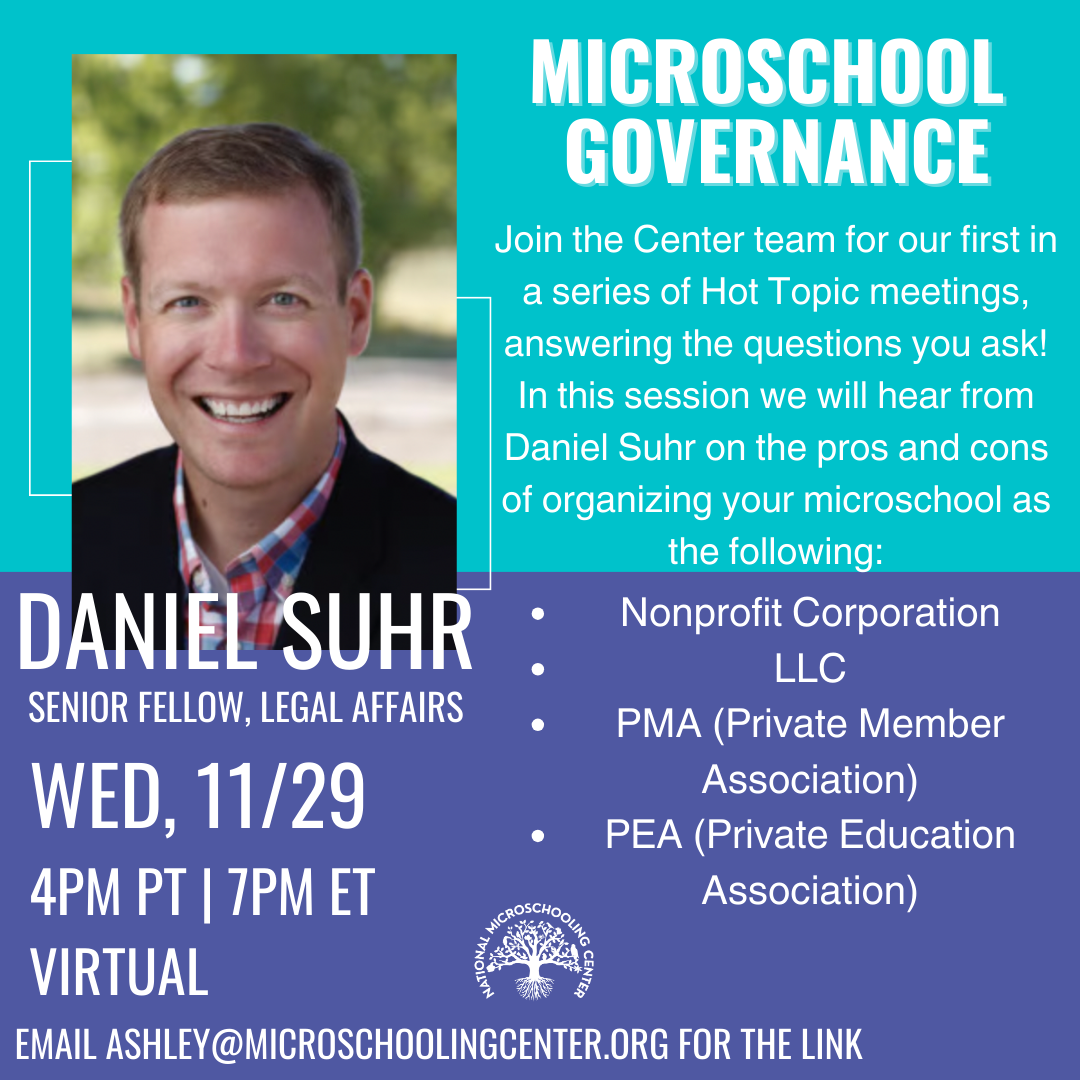

When deciding on how to structure your business as a brand-new microschool there are different governance approaches you can choose from. We talked about all of these during our November 29th Hot Topic Meeting with our legal fellow Daniel Suhr. For a rundown of governance questions relating to how to set up as an LLC or S class corporation, refer to this article.

This article talks about establishing your business as a non-profit organization. It is important to note that many microschool founders come into this process assuming they need to begin by filing for IRS-recognized nonprofit status. While status as a 501(c)(3) organization holds advantages, especially for entities planning to apply for grants from foundations who require this status, it also adds levels of complexity you may prefer to consider down the road in establishing your organization. Arrangements like fiscal sponsorship arrangements with existing nonprofits can often be made to receive such a grant.

An IRS application form carries a filing fee ($600 for the long form as of this writing, less for those who qualify for the 1020-EZ form), and other associated requirements can add to the cost of this lift. Additionally, filing an annual federal Form 990, as IRS-recognized nonprofits are required to do, can be a more time consuming process than many expect.

For this structure, you want to make sure you create a very clear mission statement and values as this is what your board will use to hold you accountable. Daniel suggests gathering 3-5 people who fully understand and support your mission and values, to serve on your board of directors. Also essential to understand is that your governing board holds ultimate authority over financial and other important decisions, so it is imperative that you can trust each other and build a working relationship that aligns with your mission and goals.

This board of directors will work to maintain the integrity of the non-profit by making sure it stays true to its mission, as well as having control over the school and staff. In this structure, you as the founder do not own the business the board does and so in turn they assume the risk as well. When touching on the topic of tax exemption this will matter to you if: people are making in-kind donations or giving above and beyond what you charge, or a grant application status calls for it.

Here is a list of steps to prepare yourself to start a non profit. You can read this article for background on the IRS application process:

1. Mission Statement: Clearly define the purpose and goals of your organization. This statement will guide your activities and serve as a foundation for your non-profit.

2. Name and Legal Structure: Choose a name for your organization that is unique and reflects your mission. Determine the legal structure, such as a charitable trust, association, or corporation, and register it according to the requirements of your country or state.

3. Board of Directors: Assemble a committed and diverse group of individuals to serve on your board of directors. They will be responsible for guiding the strategic direction of the organization, ensuring compliance, and overseeing financial aspects.

4. Bylaws: Prepare bylaws that outline the internal rules and operating procedures of your organization. These may include details about membership, board structure, decision-making processes, and fiscal policies.

5. Incorporation: File for incorporation, which will establish your organization as a legal entity separate from its founders. You may need to submit specific documents, pay fees, and follow the regulations set by your local government.

6. Tax-Exempt Status: Apply for tax-exempt status from the relevant tax agency, such as the Internal Revenue Service (IRS) in the United States. This will enable your organization to receive tax-deductible donations and potentially other benefits.

7. Fundraising Plan: Develop a comprehensive fundraising plan that outlines how you will generate the necessary financial resources to sustain your non-profit's operations. This can include individual donations, grants, events, corporate sponsorships, and more.

8. Financial Management: Set up proper accounting and financial management systems to ensure transparency and accountability. This includes creating a budget, opening a bank account, and establishing financial reporting practices.

9. Compliance and Reporting: Familiarize yourself with the legal and regulatory requirements for non-profits in your jurisdiction. Understand the reporting obligations, such as annual filings, tax returns, and compliance with charitable solicitation laws.

10. Community Engagement: Develop strategies to engage and involve the community you are serving. This can include partnerships, volunteer programs, outreach initiatives, and a strong communication plan to raise awareness about your organization's work.

Remember, starting a non-profit organization can be a complex process, so seeking legal and professional advice is recommended to navigate the specific requirements of your country or state. That said, law firms generally charge thousands of dollars for this work, and anything you can do to come to them prepared and organized can save you a lot.

.png)

When considering creating a microschool, founders generally begin by focusing on education vision and decisions. It is important at this stage to...

.jpg)

We love microschooling, and it makes all the hard work of building and running a microschool more fun. That said, some of the important tasks in...

Starting a school from scratch seems like a daunting task. Even a microschool that's serving a small student body still needs to choose curriculum,...