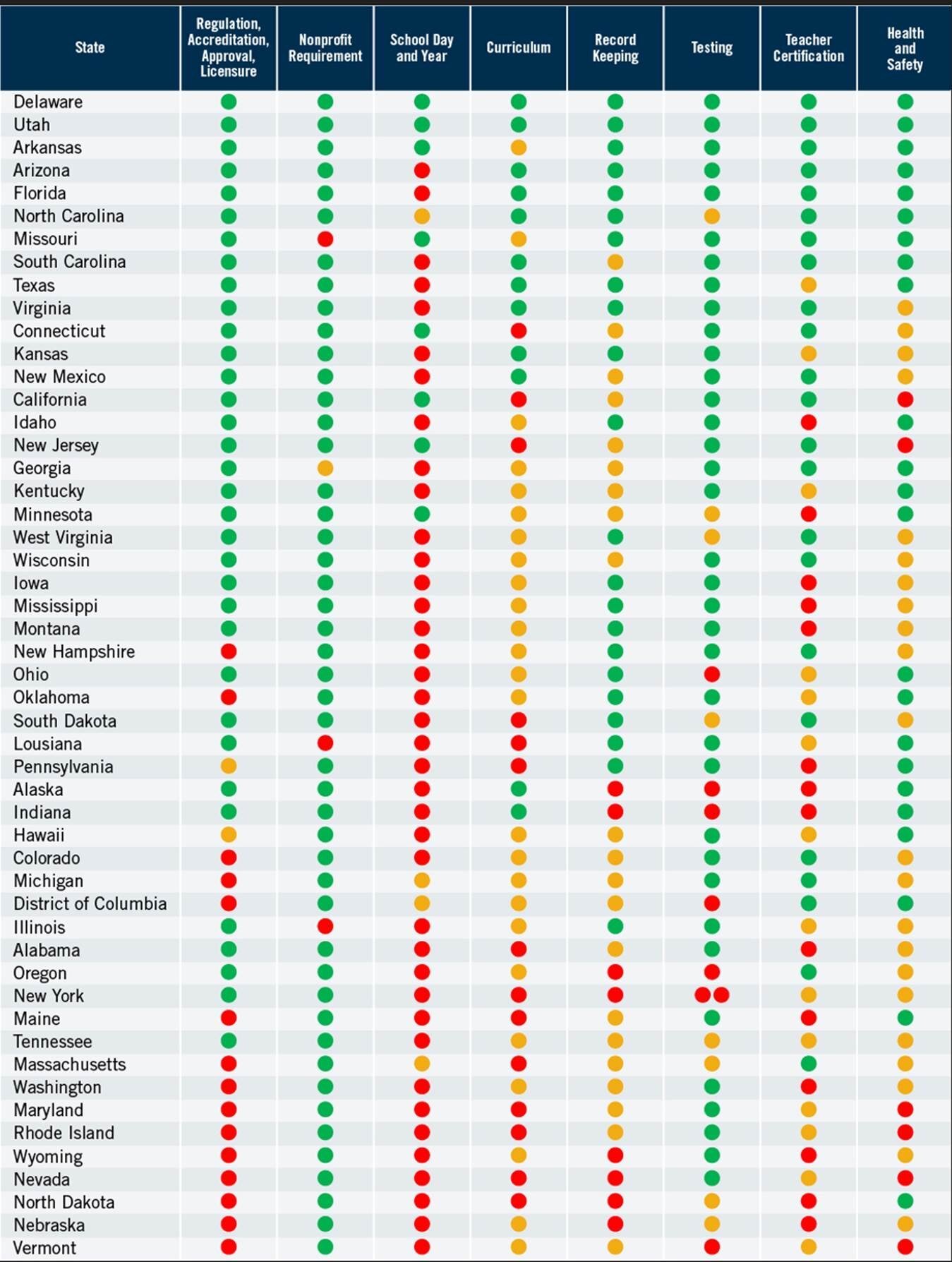

Removing Barriers to Emerging Schooling Models

America’s fast-growing microschooling movement is driven by local leaders who may not think of themselves as entrepreneurs in the sense that, had...

2 min read

Daniel Suhr and Don Soifer : Jul 10, 2024 5:25:34 PM

.jpg)

For many businesses, recent changes by the federal Department of Labor to the Fair Labor Standards Act (FLSA) concerning requirements for employers to offer overtime pay levels to certain employees are causing them to make significant changes to the ways they pay their employees. We have been getting questions from microschool leaders wondering what impacts these may require on their pay practices.

The answer for most microschools seems to be, no, probably not. But it is worth understanding the reasons and how they apply to you.

First, the agency stipulates that certain types of entities, including schools, whether operated for profit or not-for-profit, are covered by the FLSA, and required to participate, regardless of how much revenue they have.

But many microschools will not qualify as schools under the FLSA. The Act's scope includes “[e]lementary and secondary schools, which are day or residential schools that provide elementary or secondary education.” Microschools organized as learning centers serving children following their state’s homeschooling requirements, tutoring centers, or other formats that are not a registered as a ‘school’ by their state probably will not qualify as a ‘school’ under the FLSA.

For those microschools that are officially deemed to be schools, such as those that register as private schools with their state education departments, the Department also states that, “Section 13(a)(1) of the Fair Labor Standards Act, as amended, provides an exemption from the Act's minimum wage and overtime requirements for any employee employed in a bona fide executive, administrative, or professional capacity.”

In other words, if your microschool does count as a school under the law, employees who are sufficiently salaried teachers or executives / administrators (like principals) are treated as exempt from the Act, including these new provisions. If their employment is significantly less than full-time, the same exemption will likely not apply. Thus, for many microschools, FLSA compliance is limited to hourly non-teachers like teachers’ aides or office assistants.

Even for those microschools that operate as learning or tutoring centers rather than as schools, the law is intended for companies of a certain size. Generally, “the FLSA applies to employees of enterprises that have an annual gross volume of sales made or business done totaling $500,000 or more,” which is of course higher than the revenues of most microschools.

So, for the most part, while compliance with these new FLSA overtime requirements will cause many employers to change their practices, most microschools will not be impacted.

If you have questions about whether your microschool may be covered by the FLSA because of your particular corporate structure or staffing practices, reach out to an HR professional or attorney. This blog post does not constitute legal advice or create an attorney-client relationship and is informational only.

America’s fast-growing microschooling movement is driven by local leaders who may not think of themselves as entrepreneurs in the sense that, had...

When deciding on how to structure your business as a brand-new microschool there are different governance approaches you can choose from. We talked...

While the growth of school choice programs and policies around the United States continues to receive extensive attention, far less interest has been...