Public Comment on Microschool Eligibility for Federal Scholarship Tax Credit Program

The following is public comment submitted by the National Microschooling Center regarding microschools and their eligibility for federal tax credit...

4 min read

Don Soifer and Dan Lips : Nov 13, 2025 2:40:04 PM

As more employers consider creating company microschools to support their workers’ families, some clear, simple federal measures can help.

Meanwhile, as federal officials work toward implementing the federal tax credit scholarship program passed earlier this year, many in the education world have turned their focus to ensuring that families will have sufficient schooling options to utilize the new program. Some additional modest policy measures can make an important difference.

In January, President Trump issued an executive order that stated that his administration would “provide every available opportunity for parents to enrich the education of their children through education choice.” Now, the Treasury Department has an opportunity to issue guidance that could dramatically expand the number of schooling options available to American taxpayers by allowing the Employer-Provided Child Care Tax Credit to be used to provide educational services.

This article was originally published in American Thinker - you can read it here.

As background, the Employer-Provided Child Care Tax Credit was established in 2001 and made permanent in 2012. The purpose of the credit was to encourage employers to provide child care benefits for their employees. But a 2022 review by the Government Accountability Office found that this credit was claimed by less than 300 corporations. GAO cited a range of possible reasons for the credit’s limited use, including the substantial costs of operating credit, the limited tax credit amount, and even a lack of awareness. At the time, businesses could only reduce their income tax liability by $150,000 by using the tax credit.

That will change in 2026. The One Big Beautiful Bill Act that became law in July dramatically increased the potential value of this tax credit. The maximum amount of the credit will be $500,000 and the value of the credit will be 50 percent (or $600,000 and 60% respectively in the case of a small business). Employers will have a greater financial incentive to provide child care services thanks to these changes, which could help improve child care access and affordability for American families.

But this tax credit has the potential to have a much greater impact if the Trump administration wishes. The Employer-Provided Child Care Tax Credit could potentially be used to encourage employers to provide child care microschools for their employees’ children to address the complementary goals of “expanding access to high-quality child care will meet parents’ increasing demands for new schooling options for their children.”

While to date this tax credit has been used just for traditional child care, there could be broad appeal among employers to expand its use to include employer-run microschools for school-aged children.

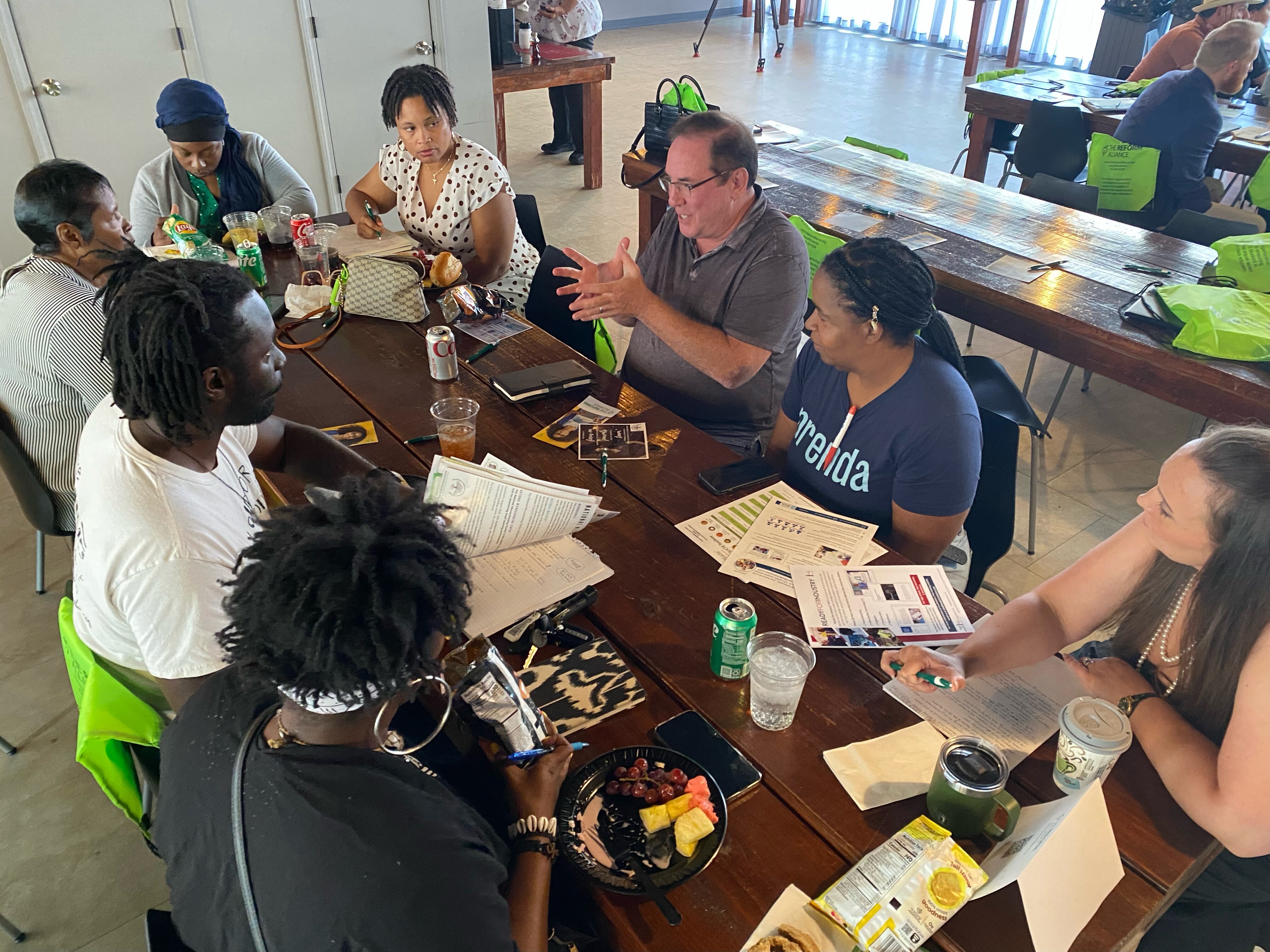

Increasingly, employers are recognizing value in starting microschools at their workplace or in workplace-adjacent facilities. An increasingly popular arrangement is to create partnership microschools, where the employer serves as host partner who contracts with a technical partner responsible for teaching and learning functions.

Such partnerships often boost productivity, leveraging assets the host can contribute like staffing for support functions, front office help or meals, allowing educators to keep focused on supporting teaching and learning, maximizing personalization. Employers describe numerous benefits in offering microschooling options which provide different returns on their investment. These vary widely by employer and circumstances:

Employers operating in tight labor markets find value in deepening benefits for employees, especially for jobs requiring specific training or experience, or as a management or executive retention asset.

Lost employee productivity is a frequent issue. For families with younger children, workdays and schooldays are often misaligned, and quality or safe afterschool care is not always available.

Also, large school districts can be notoriously inconvenient for families working multiple jobs, or working shift labor, who want to remain active in their children’s schooling experience. This can be especially true where children with special needs call for difficult-to-schedule IEP team meetings with parents present. Simplifying transportation without depending on unreliable school busing systems helps too.

Companies hiring in communities with especially limited or underperforming public school options report associated workforce challenges for hiring and retention.

Some companies find it advantageous for their own workforce-preparation considerations to offer microschools built around apprenticeships.

Other family-friendly employers which embrace specific workforce values- or principles recognize opportunity to advance these through specially aligned and designed microschool models.

With the expanded tax benefits for employer-provided child care in the recent reconciliation bill, family-friendly companies seeking to support employees and children can now take advantage of new opportunities to support this work. One simple clarification would clearly extend this to microschools serving school-aged children as well. These different types of programs generally fall within different rules and requirements defined at the state level, each appropriate to the ages of children served, so a federal change would clarify that the pertinent sets of requirements would apply.

The federal law is written in a manner that offers the Treasury Department the opportunity to broadly interpret the credit to be used by employers that provide child care which could naturally include educational services. Specifically, the law defines a “qualified child care facility” as a facility that “the principle use of which is to provide child care assistance,” and which “meets the requirements of all applicable laws and regulations of the state or local government in which it is located, including the licensing of the facility as a child care facility.”

In other words, a facility established by an employer using this federal tax credit must only meet state and local rules for providing child care. The law does not limit the services that can be provided. The Treasury Department could simply issue guidance to employers clarifying that child care centers can include education services for school-aged children as well. Such a modest change could give employers across the United States the option of offering child care and schooling services as a new benefit for their employees.

In 2026 and beyond, a federal incentive for employers to provide these benefits to their employees could help meet expected parental demand for new schooling options. Thanks to the growing number of states establishing education savings account programs, nearly half of the nation’s schoolchildren are now eligible to attend a school of their parents’ choice. Once the new federal scholarship tax credit takes effect in 2027, taxpayers may choose to fund more than a million new scholarships for American children.

For the growing national education choice movement to succeed, parents will have new schooling options. A modest change to expand the Employer-Provided Child Care Tax Credit could be an important step.

The following is public comment submitted by the National Microschooling Center regarding microschools and their eligibility for federal tax credit...

Will families be able to use scholarship dollars from the new federal scholarship tax credit passed this summer to pay for their children to attend...

Educational freedom continues to make major gains around the United States. Yet families, even those in many of the states where school choice...